Capital Gains Tax is a kind of tax that is realized on real estate properties, jewelry, bonds, stocks, and other kinds of assets. There are various rates of this tax in different countries. In this article, we are going to discuss everything about capital gains tax in Malta.

Capital Gains Tax is calculated during the transfer or sale of individual assets including residential properties, jewelry, stocks and bonds, and all kinds of assets. Since a profit is made during this process, the capital asset falls under regular incomes and it can be both short-term and long-term.

Most incomes are taxable, and capital gains are no exception. This sort of tax is only payable during the time of sale of the property when the gains are realized. Every country has different structures and regulations regarding capital gains. While some countries are strict and apply a considerable tax on individual or organizational gains and capital, there are certain countries that don’t apply any tax on capital profits.

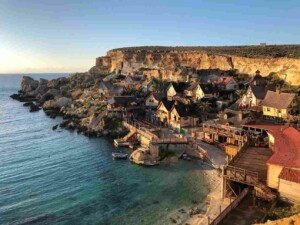

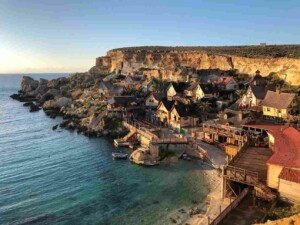

In Malta, there are certain things to consider about capital gain tax. If you are thinking about buying any property in Malta or investing in Malta, you should be aware of the rules and regulations of Capital Gains Tax Malta. The current trends of capital gains concern both residents and non-residents in the country.

Capital assets are all types of individual or organizational assets that can be sold and made certain profits upon. The capital gains tax does not apply to any unsold or stagnant assets which have not been realized yet. There are both short-term and long-term capital assets, which you’ll find more information on below.

On the basis of residency type, the tax in Malta is applied to all residents and non-residents for their regular income and some specific capital gains. The rate of capital gain tax can be anything between 15% to 35%. The rate and the chargeable tax amount are decided on the nature of the resident. Malta’s tax structure, along with a double tax treaty and various other plans to benefit both residents and non-residents, can help you achieve significant fiscal efficiency in Malta.

If you are a non-ordinary, non-domiciled, or foreign individual in Malta and have been planning on investing in Malta, you can benefit from the Malta citizenship by investment plan, which offers an expedited route citizenship by naturalization . We can offer profitable and practical solutions for all kinds of citizenship investment plans in Malta.

For information on the nature of residency for the calculation of personal income tax, check out the glossary section of our page.

Malta does not have any variable tax structure for corporate companies in the country, and directly applies a 35% flat-rate tax for all kinds of chargeable incomes and corporate capital gains. The imputation system of tax applies to both resident and non-resident shareholders of any company.

If a company is based in Malta and ordinarily resident and domiciled, then its worldwide income will be considered for taxation in Malta. Even if a company is not ordinarily based or domiciled in Malta, but is controlled, managed, or operated in Malta, it would be subject to tax liability. For invested Malta stocks, both personal and corporate gains are subject to capital gain tax. The situations leading to the liability of this tax can be as follows:

The legislation of Malta has distinctive recommendations on which properties or assets need to be assessed for capital gains tax imposition. According to the Maltese tax legislation, all kinds of static intellectual property and secured financial assets can be subject to capital gain and therefore will be taxable at the time of transfer of authority. Due to the double tax treaty system and variable rate of capital gain tax for individuals, many non-resident and temporary residents can invest stocks in Malta along with other assets while making great profits.

Only the kind of asset transfers occurring in Malta would be liable for capital gains tax. Or if the asset holders, both individual and corporate, are ordinary residents of Malta or domiciled here, the profits made during the transfer of assets can be calculated for this tax, along with the regular taxable income of the taxpayer. If you are planning to invest in Malta , go through our detailed guides and feel free to consult our experts for suggestions, who are more than happy to help.

Depending on the source and nature of income, all kinds of taxed income are later on allocated to different tax accounts. One of the distinguished categories in this regard is the immovable property account. Thus, if you plan on transferring any immovable property in Malta, it will be subject to Property Transfer Tax (PTT) instead of a capital gain tax. To explain in detail, there is not any imposed tax on the profit made during the transfer, rather the property transfer tax is deduced according to the cost of the transaction and such a tax is not a tax on the capital. This tax is usually set at a flat rate of 8% for the initial selling price or transfer value of the transfer of the immovable property. Of course, there are certain exceptions for properties sold and transferred before the year 2004. And, if you resell your immovable property within 5 years of your possession, your property transfer tax will be chargeable at only a 5% rate

Good news for people investing from foreign sources in Malta, there is no income tax levied on the income, even if it is earned in a Maltese bank account. According to the Maltese tax regulations, you do not have to pay any income tax imposed for capital gains if you are selling or buying shares in any foreign stock markets. So, this is a huge investment opportunity for foreigners in Malta. Malta is also a much more flexible country for other tax liabilities including gift tax, wealth tax, inheritance tax, etc. Compared to other countries in Europe, Malta seems to be a far better location for foreign investors to earn consistent profit through foreign-sourced capital gains. If you happen to be a non-resident foreign entrepreneur, you can gain significant profits and a huge tax refund through versatile business opportunities in this country.

The Malta HNWI Residence scheme is an upgraded special tax scheme that has replaced the previous permanent residency taxes in Malta. HNWI stands for High Net Worth Individual residence scheme, which allows foreign investors to enjoy special rebates and exciting tax offers on their foreign-sourced income remitted in Malta. Businessmen and industrialists that have sufficient revenue and net worth can take up residences in Malta under the HNWI residence scheme. The number of tax rebates and special status for these high net worth individuals will be calculated on the basis of their total taxable income, financial graph, and industrial qualifications.

Under the HNWI residence scheme, the foreign-sourced income remitted in any Maltese bank account will be subject to tax liability at a flat rate of 15% for HNWI permit holders. This residence scheme only addresses two categories of HNWI: a) Nationals from the European Union and the European Economic Area, and b) Nationals from third countries. Even though the foreign-sourced incomes will not be taxable for capital gain, the investors have to observe the annual income tax ranging from EUR 20000 to EUR 25000. HNWI permit holders can enjoy the double tax relief from capital gains under the wide network of Malta’s double tax treaty relief.

For many entrepreneurs and business personalities, Malta is one of the most profitable countries in Europe for all sorts of investments. Be it housing plans, selling or sharing stocks in Malta, or enjoying asset-related profit from foreign sources, you can enjoy some pretty exciting offers by investing in Malta. This destination is a solid platform for a wide array of business opportunities. Read on to know about all the reasons why you should invest in Malta .

Under the Malta Citizenship by Investment Program, which is more accurately referred to as the Maltese Citizenship Act Granting of Citizenship for Exceptional Services Regulations, you can enjoy huge tax rebates with foreign-sourced incomes. Under this scheme, any high-income individual can get an easy and stable residence in Malta by investing substantially in Malta’s national economy. Even when you are planning financially for your retirement, check out our tips for retiring in Malta .

It is dependent on the residential status of the taxpayer and can range anywhere from 15% to 35%.

Foreign sourced earnings are not accounted for capital gain tax in Malta, even when extracted through Maltese banks.

Only during the transfer of assets, the capital gain tax arises and is calculated according to the profit made.

Tourism, financial and investment sectors, communication, real estate, gaming and technology and pharmaceutical sectors are some of the most important capital gain sectors for foreign direct investments in Malta.

Table of Contents

LinkedIn Facebook Instagram YouTube Medium